If the units are not sold, the costs will continue to be included in the costs of producing the units until they are sold. This treatment is based on the expense recognition principle, which is one of the cornerstones of accrual accounting and is why the absorption method follows GAAP. The principle states that expenses should be recognized in the period in which revenues are incurred. Including fixed overhead as a cost of the product ensures the fixed overhead is expensed (as part of cost of goods sold) when the sale is reported. A company’s breakeven point is the level of output where total revenues equal total costs (fixed and variable costs combined). Variable costs impact this point because as the production volume increases, variable costs rise.

Everything You Need to Know About Variable Costs

- Your manufacturing profit is $40,000, with $10,000 (1,000 x $10) on the balance sheet as inventory.

- The company should accept the special order based on the variable costing formula, as it will increase profits by ₱5,570,000.

- Half of the $40,000 in fixed production cost ($20,000) will be included in inventory at the end of the period, thereby lowering expenses on the income statement and increasing profit by $20,000.

- One of the main advantages of variable costing is that it provides a more accurate picture of the cost of producing a product or service.

- This can make it somewhat more difficult to determine the ideal pricing for a product.

The manager’s hesitation stemmed from mistakenly including fixed costs in the calculation. Since the company has enough capacity, there won’t be additional fixed costs for producing the extra 1,000,000 units. Direct materials cost ₱8,325,000, direct labor is ₱4,162,500, and variable overhead is ₱4,440,000. Total variable costs amount to ₱16,927,500 for 1,000,000 units, which equals ₱16.93 per phone case. Variable costing will result in a lower breakeven price per unit using COGS.

Determining Breakeven Price Using Variable Costing

Since variable costing treats fixed manufacturing overhead costs as period costs, all fixed manufacturing overhead costs are expensed on the income statement when incurred. Thus if the quantity of units produced exceeds the quantity of units sold, absorption costing will result in higher profit. Another advantage of using variable costing internally is that it prevents managers from increasing production solely for the purpose the standard deduction of inflating profit. For example, assume the manager at Bullard Company will receive a bonus for reaching a certain profit target but expects to be $15,000 short of the target. The company uses absorption costing, and the manager realizes increasing production (and therefore increasing inventory levels) will increase profit. The manager decides to produce 20,000 units in month 4, even though only 10,000 units will be sold.

Operating Expense: A Complete Guide for Philippine Business

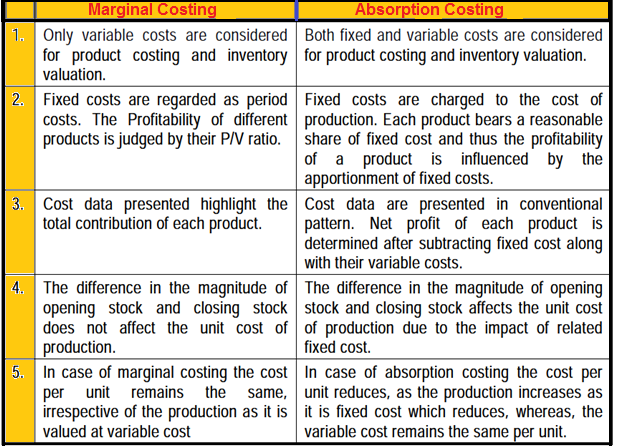

Variable costing and absorption costing are two different methods of allocating costs for product costing and income statement reporting. The key difference lies in how fixed manufacturing overhead costs are handled. Under variable costing, fixed manufacturing costs are treated as an expense in the period incurred rather than capitalized into inventory. Absorption costing considers all fixed overhead as part of a product’s cost and assigns it to the product. Variable costing doesn’t add fixed overhead costs into the price of a product so it can give a clearer picture of costs. These costs are hidden in inventory and don’t appear on the income statement when assigning these fixed costs to the cost of production, as absorption costing does.

The Pros & Cons of Variable Costing Accounting

Absorption versus variable costing will only be a factor for companies that expense costs of goods sold (COGS) on their income statements. Any company can use both methods for various reasons but public companies are required to use absorption costing due to their GAAP accounting obligations. You can find a company’s variable costs on their balance sheet under cost of goods sold (COGS).

As a result, it becomes easily understandable as to how much additional profit will be earned from how much additional sales. Cost control becomes easier because only variable manufacturing costs are considered. The manufacturer only considers variable manufacturing costs to ease cost control. For example, raw materials may cost $0.50 per pound for the first 1,000 pounds. However, orders of greater than 1,000 pounds of raw material are charged $0.48. In either situation, the variable cost is the charge for the raw materials (either $0.50 per pound or $0.48 per pound).

By reducing its variable costs, a business increases its gross profit margin or contribution margin. Variable costing18 requires that all variable production costs be included in inventory, and all fixed production costs (fixed manufacturing overhead) be reported as period costs. Variable costs are directly related to the cost of production of goods or services, while fixed costs do not vary with the level of production. Variable costs are commonly designated as COGS, whereas fixed costs are not usually included in COGS. Fluctuations in sales and production levels can affect variable costs if factors such as sales commissions are included in per-unit production costs.

But again, at the root is understanding and accurately calculating variable costs. Accurate variable costing plays a role in helping the company determine an accurate break-even point enabling them to set profitable prices. Understanding the distinction between variable and fixed costs is crucial for financial planning, budgeting, and evaluating business expenses. Rather, fixed manufacturing overhead is treated as a period cost, and, like selling and administrative expenses, it is expensed in its entirety each period.